Say goodbye to manual data entry

Set export rules to determine when an expense is sent from Weel into your accounting software. Then relax, knowing that your accounting system is updated with the spend data you need.

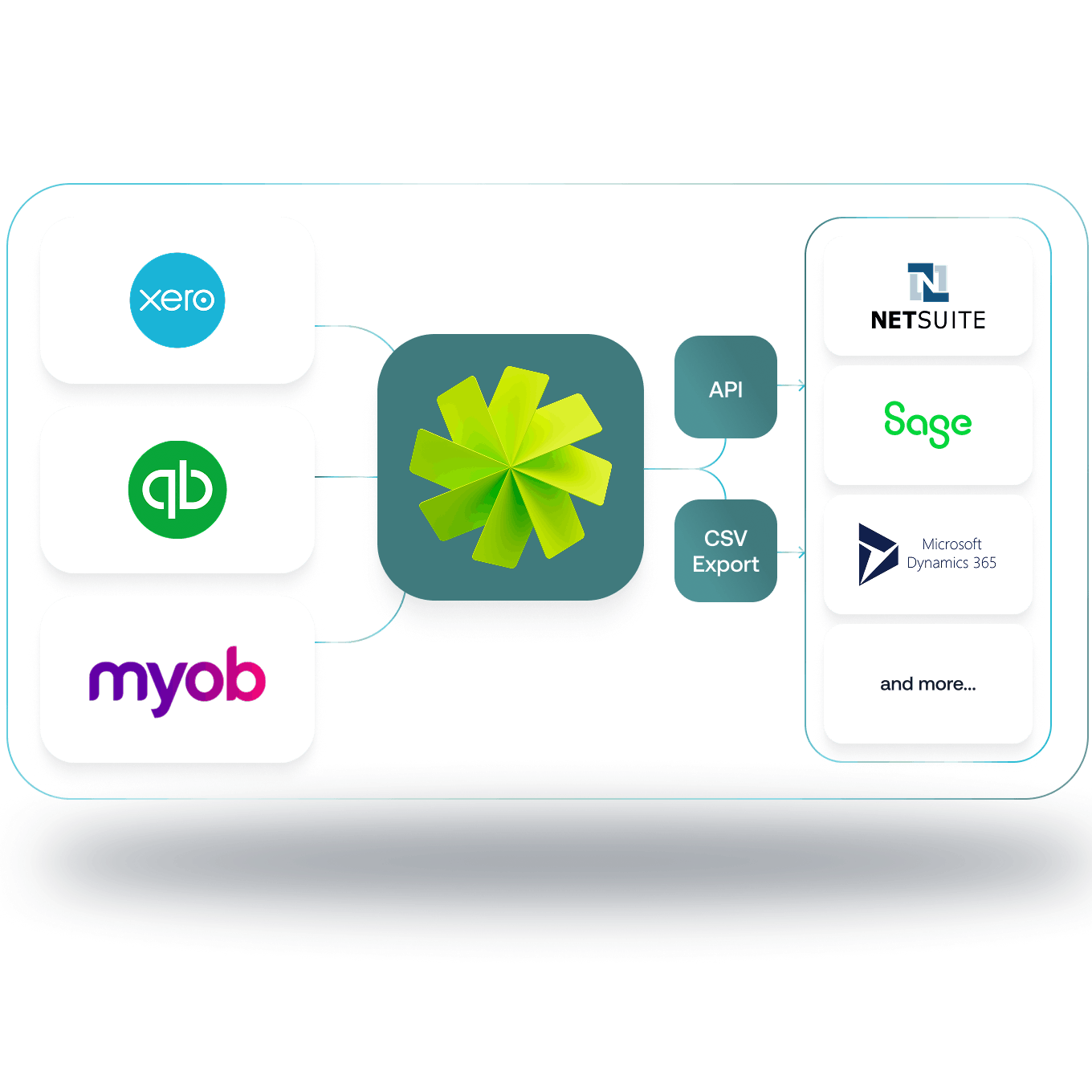

All your company spend, auto-coded and synced with Xero, QuickBooks and more - so your finance team can skip the admin and lead with insight.

Set export rules to determine when an expense is sent from Weel into your accounting software. Then relax, knowing that your accounting system is updated with the spend data you need.

Integrate your accounting software in just a few clicks

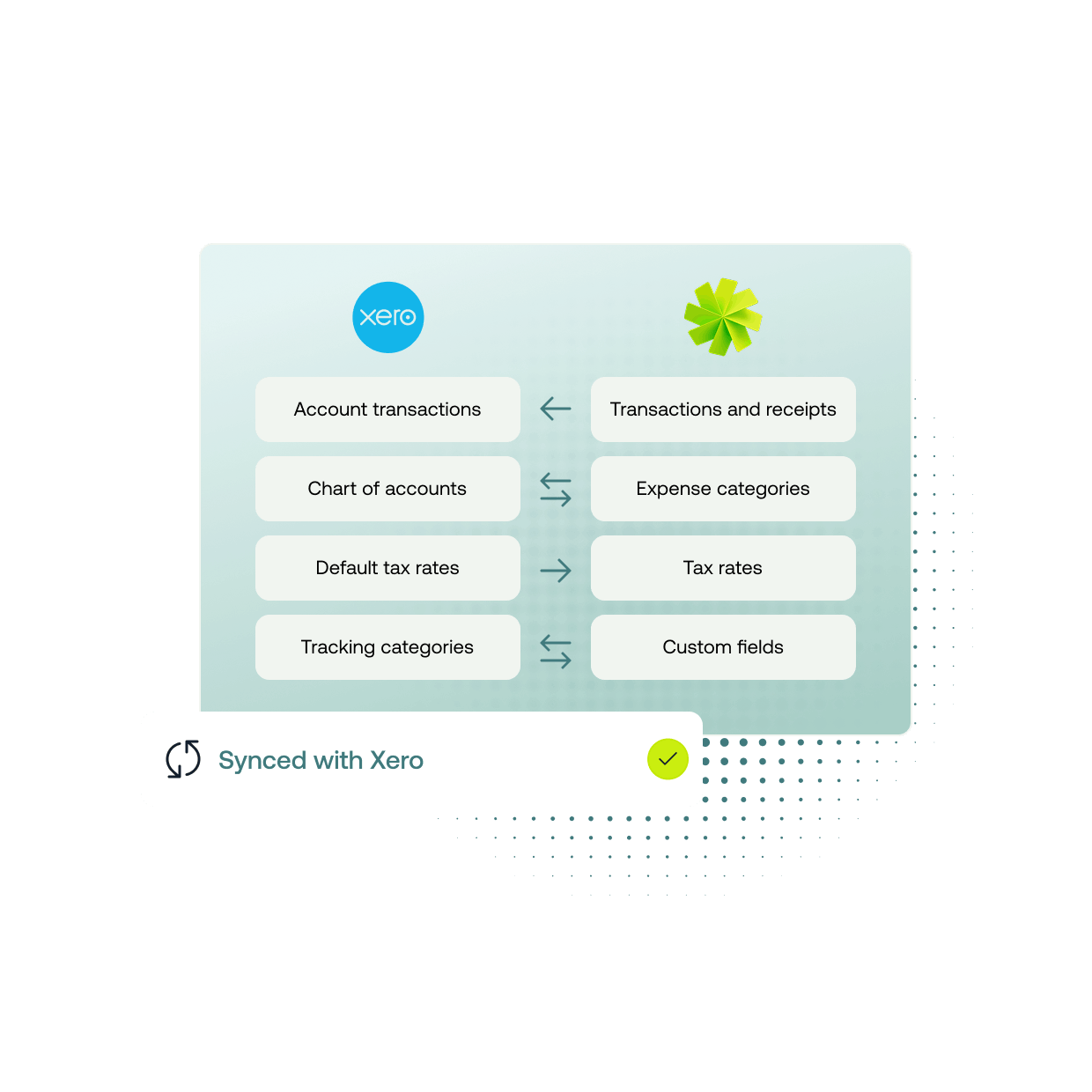

GL codes and categories are mapped into Weel, ready for coding

Transactions will push into your accounting software the moment spend is approved, with receipts attached

The status column lets you know where any transaction is between Weel and your accounting system

We love accountants and bookkeepers, and they love us. Which is why we started our partner program, to help reward our accounting and bookkeeping professionals that are helping introduce their clients to Weel.

Michael Jun, Accountant, Xero Marketplace

Yes, integrating Weel with your accounting software can be done in just a couple of clicks.

Yes, receipts and tax invoices will automatically import into your accounting software so you can reference the source document in your own system.

Because Weel’s virtual cards work like a debit expense card you will need to top-up your Weel account balance before spending. If your bank is NPP (New Payments Platform) enabled, your transfers will be almost immediate, otherwise, any funds transferred into your account balance before 4pm will settle on the same day. Direct debited funds will take between 3-5 working days to settle in your account balance.

Yes, Weel works seamlessly with all accounting systems. If you are a Xero, MYOB Account Right or Quickbooks user Weel will automatically import all transactions into your accounting software for you. If you use any other accounting software you can use Weel’s smart filters and exports to generate a custom CSV ready for import into your system.

Yes, any changes made in Weel will be automatically reflected in your accounting system ensuring that both systems are kept up-to-date. The only exception to this is when a transaction has been reconciled or an accounting period has been locked.

Yes, your chart of accounts and tracking categories will import into Weel automatically so that they can be coded against each transaction