Product

Solutions

Resources

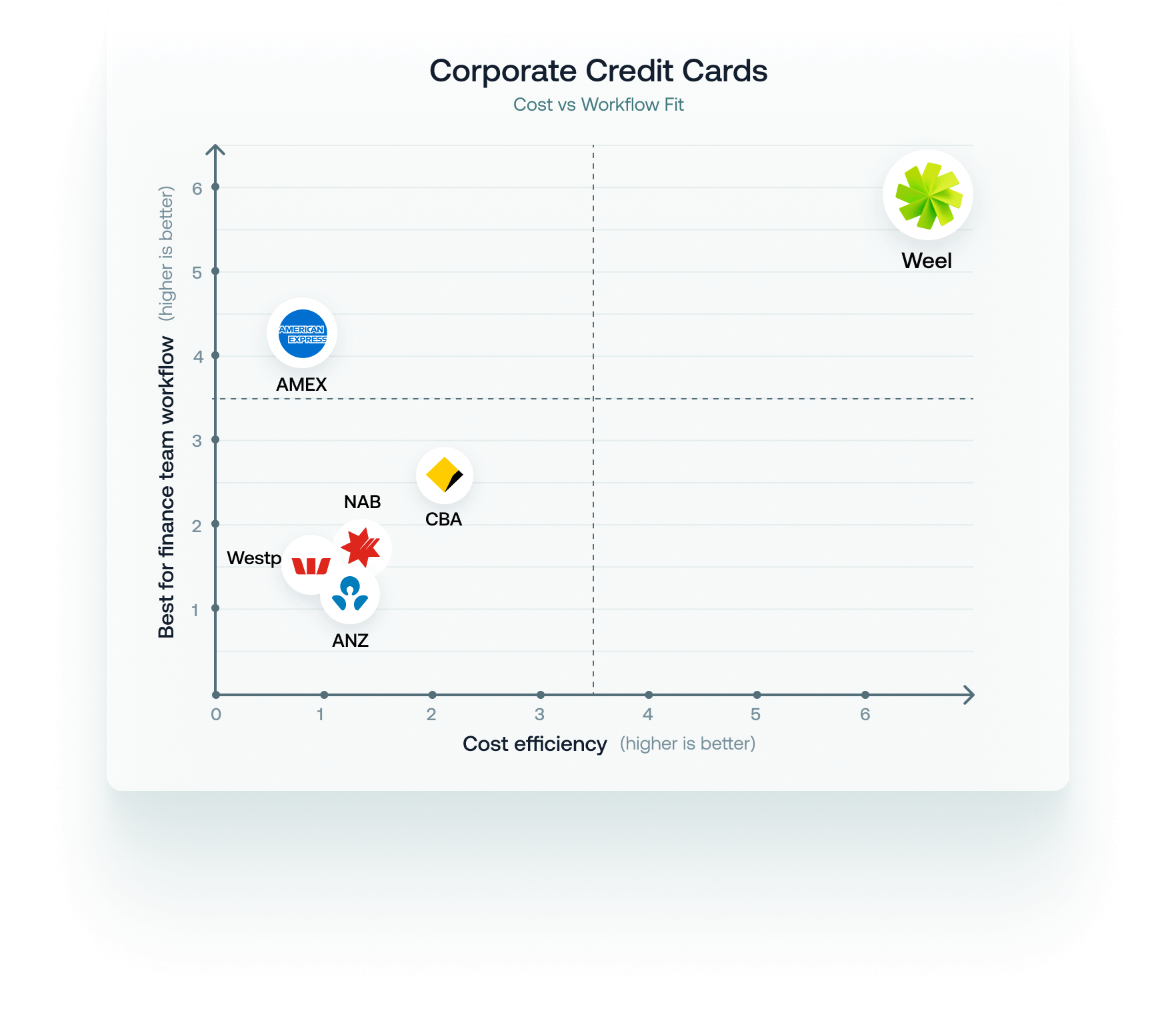

Traditional business cards weren’t built for real-time visibility or control, just shared logins, delayed data, and spend you can’t see until it’s too late.

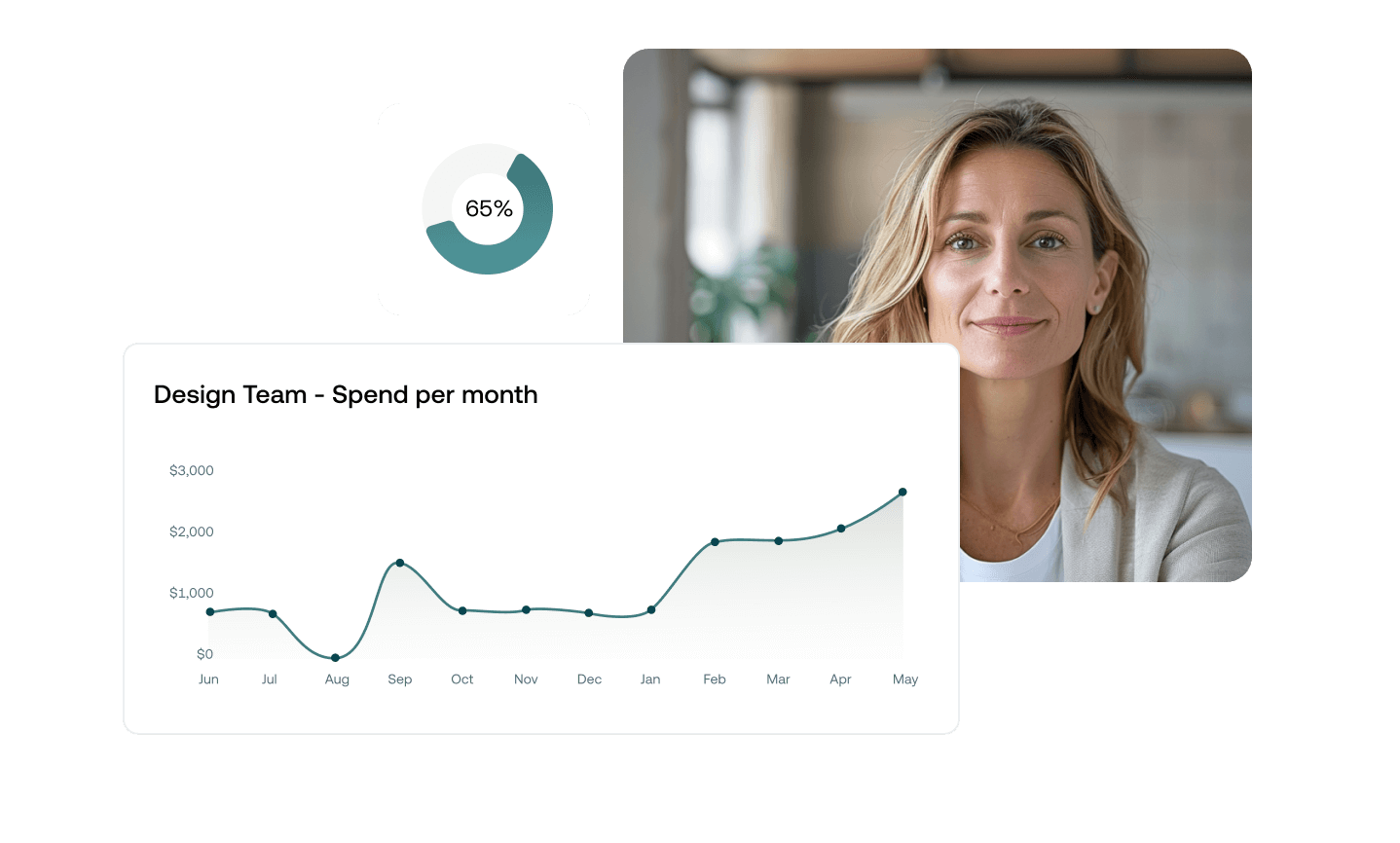

Set spending limits, manage transaction-level reporting, and track every dollar, without chasing receipts.

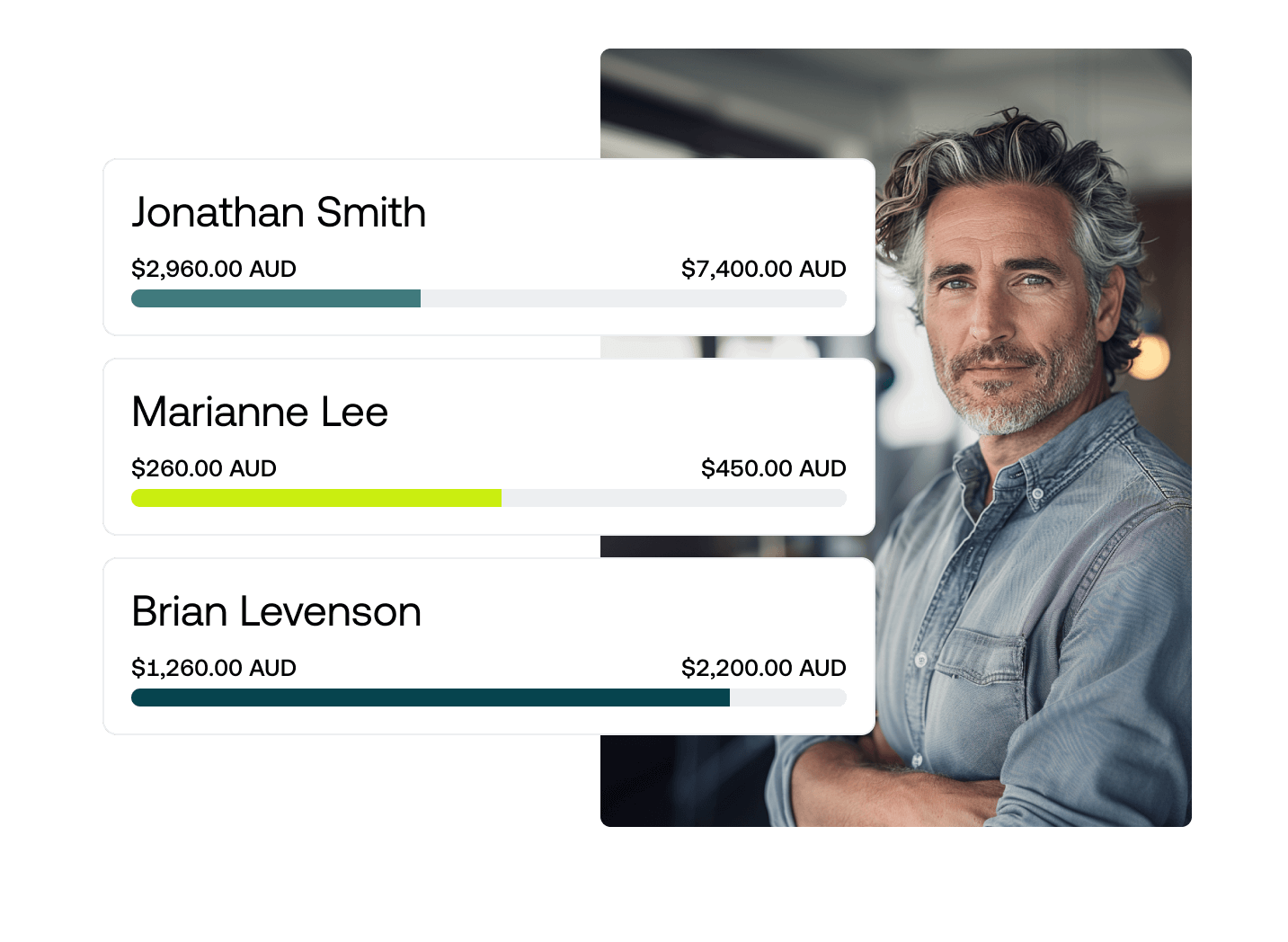

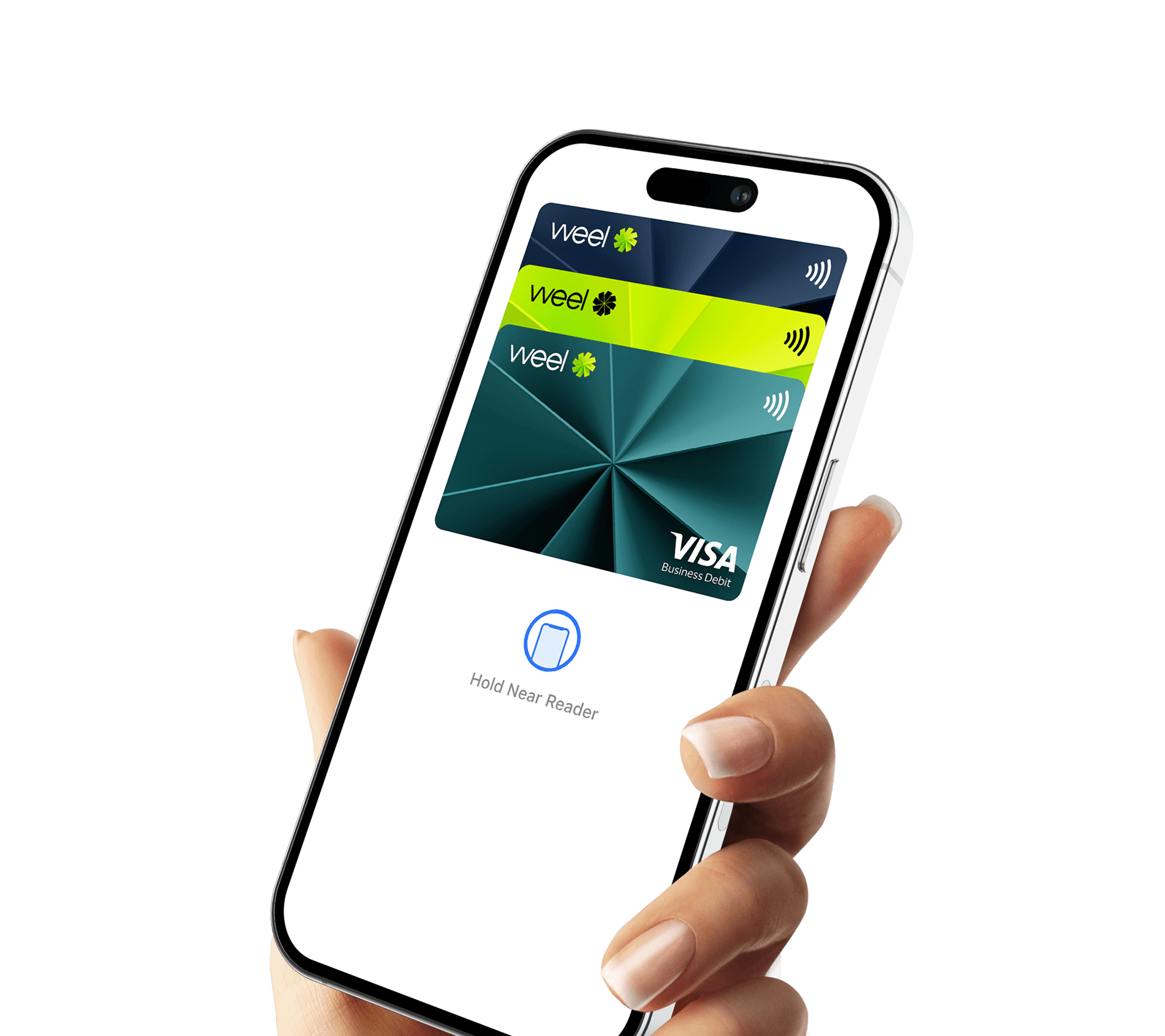

Issue virtual cards in seconds, with spend limits down to the dollar.

Weel automates expense reporting and syncs seamlessly with your accounting system

Track and review employee spending in real-time and flag outliers before they impact your business.

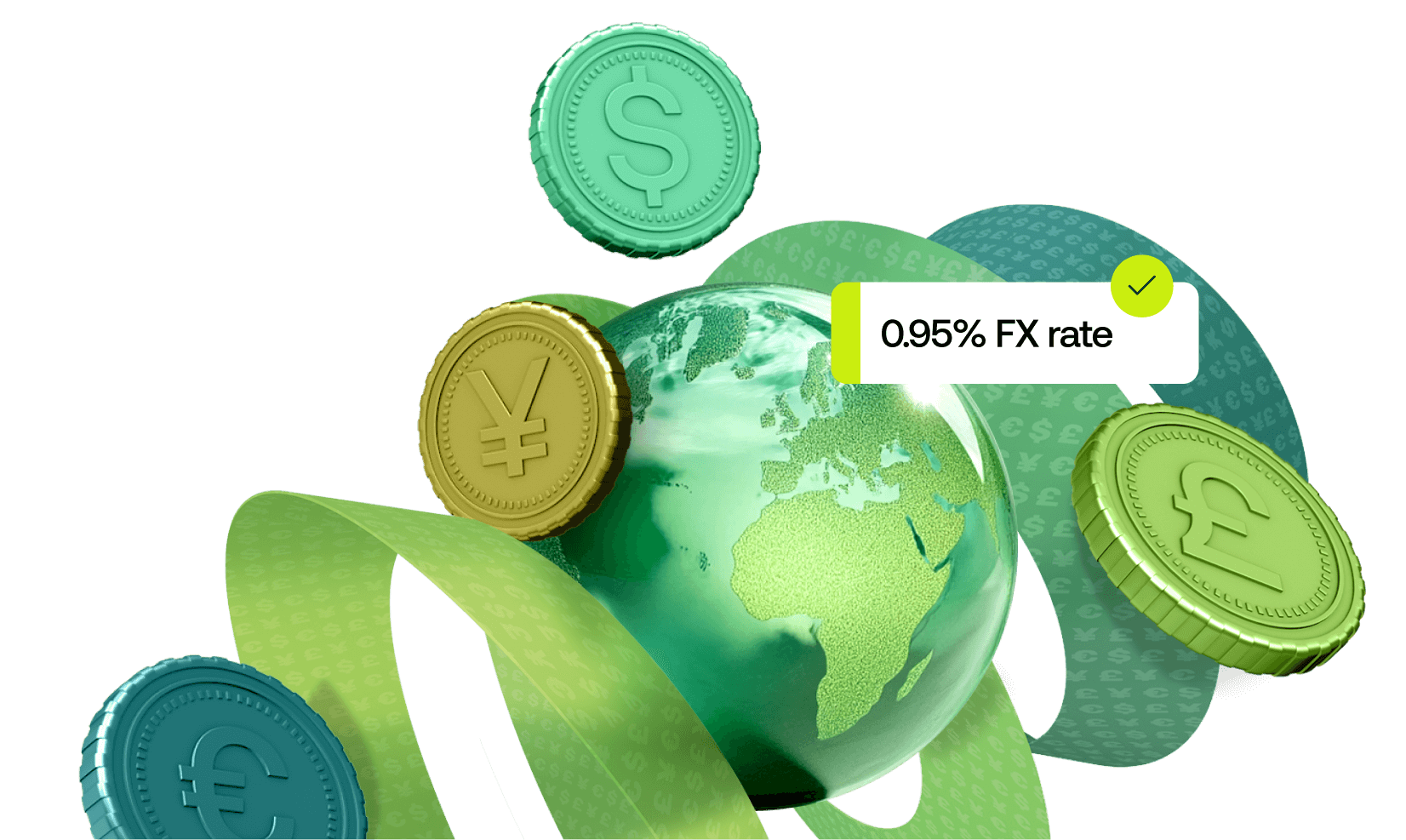

Weel keeps it simple with a low 0.95% FX rate, compared to the 3% you’ll find on most traditional cards.*

Set custom approval workflows, enforce spend limits, and automatically freeze cards when receipts aren’t submitted, so employee spending stays compliant by default.

*FX rates may vary per bank

Features

Weel corporate cards

Bank credit cards

Issue virtual and physical cards instantly

Interest rates & fees

$0

Up to 20%+ interest p.a.*

Control over employee card use

Delayed

Integration with accounting systems

Pause or cancel any card, anytime

Annual fees

Simple monthly fee

Yes

Custom spending limits

Streamline invoice payments with automated accounts payable

Fast onboarding with minimal set-up

Competitive FX rates for international payments

0.95% FX rate

Up to 3% FX rate*

*Interest and FX rates may vary per bank

No more credit checks, interest rates, or relying on clunky banking solutions. Just clear limits, digital tools, and full oversight of every transaction.

“Weel enabled us to deploy 200 virtual debit cards on day one, immediately cutting store expense admin by 870 hours per month and reducing processing time by 70%.”

.png)

Strengthen your financial health and empower your organisation to scale faster.

.png)

Consolidate your tools into a single platform and manage spend with robust controls, real-time tracking and automated approvals.

Speed up month-end close without sacrificing accuracy with AI-powered reconciliation and ERP integrations.

Easily manage and approve employee spend with intuitive software powering cards and expense management.

Weel offers virtual corporate cards that function as debit cards, providing instant issuance, real-time expense tracking, and customisable spending limits, all without the risks of debt and interest associated with traditional credit cards.

A Weel Card is a virtual corporate card designed for businesses to manage expenses efficiently. Unlike traditional credit cards, Weel Cards function like debit cards, drawing funds directly from your Weel account. They offer instant issuance, customisable spending limits, real-time tracking, and automated receipt collection, all managed through a user-friendly platform. It's a modern, secure way to control and monitor business spending without the risks of debt and hidden fees.

To get started with Weel, you’ll need to provide some basic business details, such as your ABN or NZBN and registered business address. Depending on your business structure, we may also need to verify the identity of beneficial owners, which can involve uploading two forms of ID. The process is quick, straightforward, and far simpler than applying for a traditional business credit card. Once verified, you can start issuing cards right away.

Weel leverages modern technology to provide instant virtual card issuance, eliminating the lengthy application processes of traditional credit cards.

Weel automates the entire reconciliation process, matching transactions with receipts in real time and integrating with your accounting software to reduce manual work. Learn more about how Weel simplifies credit card reconciliation.

Many businesses are recognising the benefits of virtual corporate cards like Weel for their expense management. Their control, real-time tracking and avoidance of debt are making them an increasingly popular alternative.

Weel focuses on transparent pricing with minimal fees. Unlike traditional credit cards, Weel avoids hidden charges like annual fees or interest, providing a cost-effective solution.

Yes, business expenses made with Weel's virtual corporate cards are generally tax deductible, similar to other business expenses. Consult with a tax advisor for specific advice.

Weel's virtual corporate cards offer instant issuance, enhanced security, and real-time tracking, while traditional physical credit cards involve lengthy applications, potential debt, and delayed expense reporting.

By utilising Weel's customisable spending limits, real-time tracking, and automated receipt collection, businesses can gain better control over their expenses and optimise their financial management.

Yes, Weel allows you to issue unlimited virtual corporate cards to your employees, each with customisable spending limits and tracking, providing granular control over business expenses.