No more debit card sharing

The days of card sharing and fraud risk are over. Set your team up with Weel’s secure, virtual business debit cards that work just like a plastic card, for one-off or recurring expenses.

Weel’s all-in-one platform combines instant debit cards with real-time tracking and effortless reporting, so finance teams can lead, not chase admin.

The days of card sharing and fraud risk are over. Set your team up with Weel’s secure, virtual business debit cards that work just like a plastic card, for one-off or recurring expenses.

Say goodbye to lengthy application waiting games that come with traditional debit cards. With Weel, you can issue virtual debit cards right away and whenever a new team member joins.

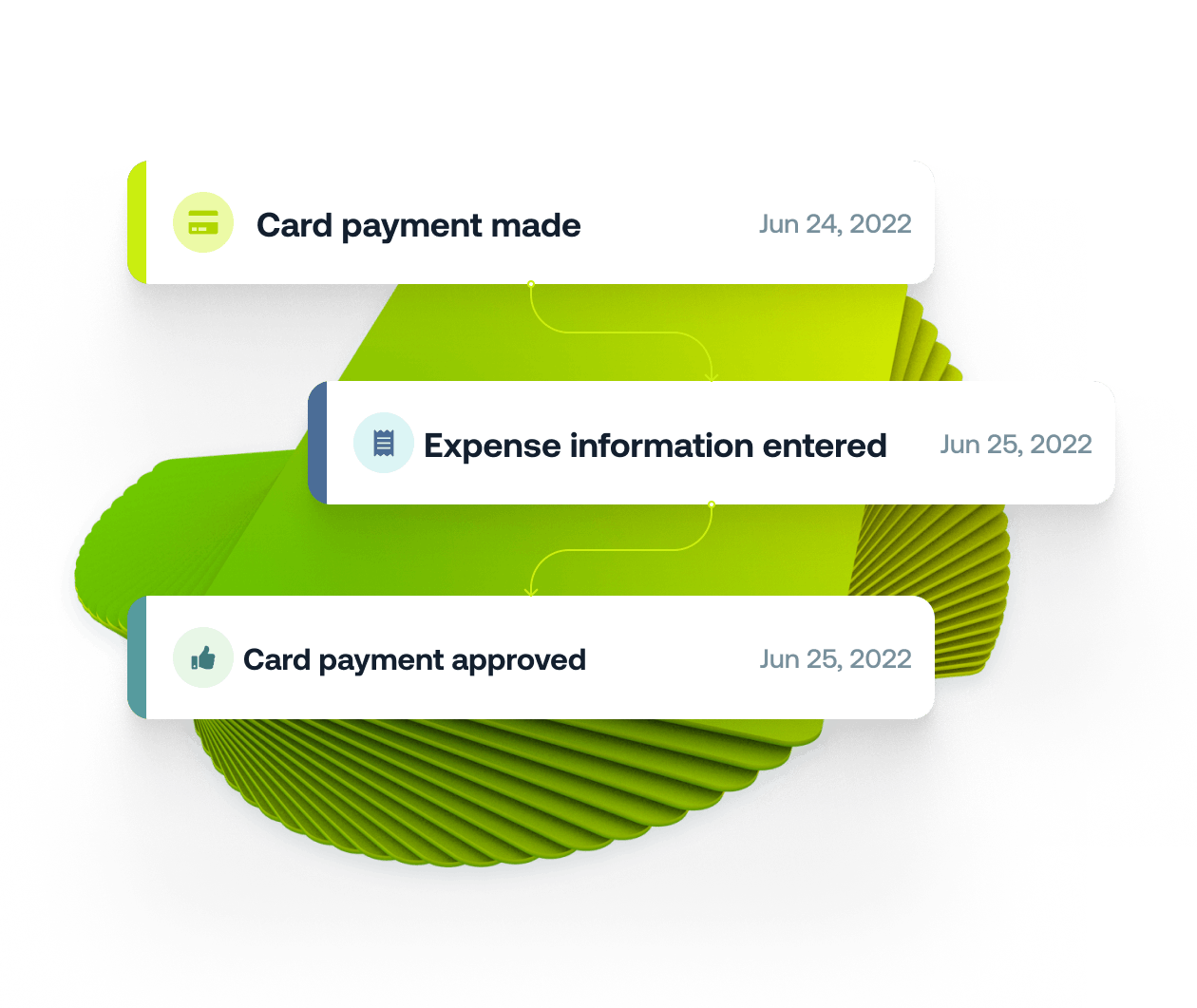

Unlike old-school debit cards, our smart debit cards come with built-in software that prompts your team to snap a photo of their receipt and capture expense information right from our mobile app.

Get the complete picture on company spending, without waiting for a bank statement. View an accurate, to-the-minute transaction table to monitor card, subscription and bill payments.

Unlike traditional debit cards, Weel lets you build your own expense policy and approval flows into our platform. It’s the easiest way to keep spending under control and avoid nasty month-end surprises.

Say goodbye to your lengthy reconciliation process by using Weel's virtual cards. Every transaction is pulled into Weel in real-time, allowing you to automate your reconciliation process. Once an expense report is complete, expense data with their receipts are sent straight to your accounting system.

Vicky Scott, Financial Accountant at Rous County Council

Some of the best benefits are that you can protect the misuse of funds, there is no lengthy bank paperwork, increase completion of expense reporting and improved insight into business spending.

Weel allows you to set granular spending controls on a card by card basis, while real time reporting and automatic expense categorisation saves you hours of administrative work. Weel also provides you with a budgeting tool to better understand and analyse your company’s spending

Virtual business debit cards are very similar to physical cards but exist in a smartphone's virtual wallet. They can be distributed to staff members much quicker than a physical card and also be easily locked or removed.

All Weel card transactions are protected against fraud and other unauthorised activity in accordance with Visa's Zero Liability Policy. We use the latest fraud detection and AI technology to analyse user behaviour and immediately block any suspicious activity. If you’re worried that a virtual card has been compromised, you can instantly deactivate and replace a user’s cards. Funds are securely held in trust at an Authorised Deposit Taking Institution (ADI).

Create your first virtual card to see how easy it is to start saving.

WeMoney Business Awards 2024 Winner: Corporate Card management Platform of the Year (Debit Card)