Send expenses to Xero. No more data entry.

Close your books in half the time - Weel automatically syncs all your transactions, receipts, and categories with Xero.

Loved by businesses, accountants and bookkeepers across Australia and New Zealand

From hours of data entry, to reconciling in seconds

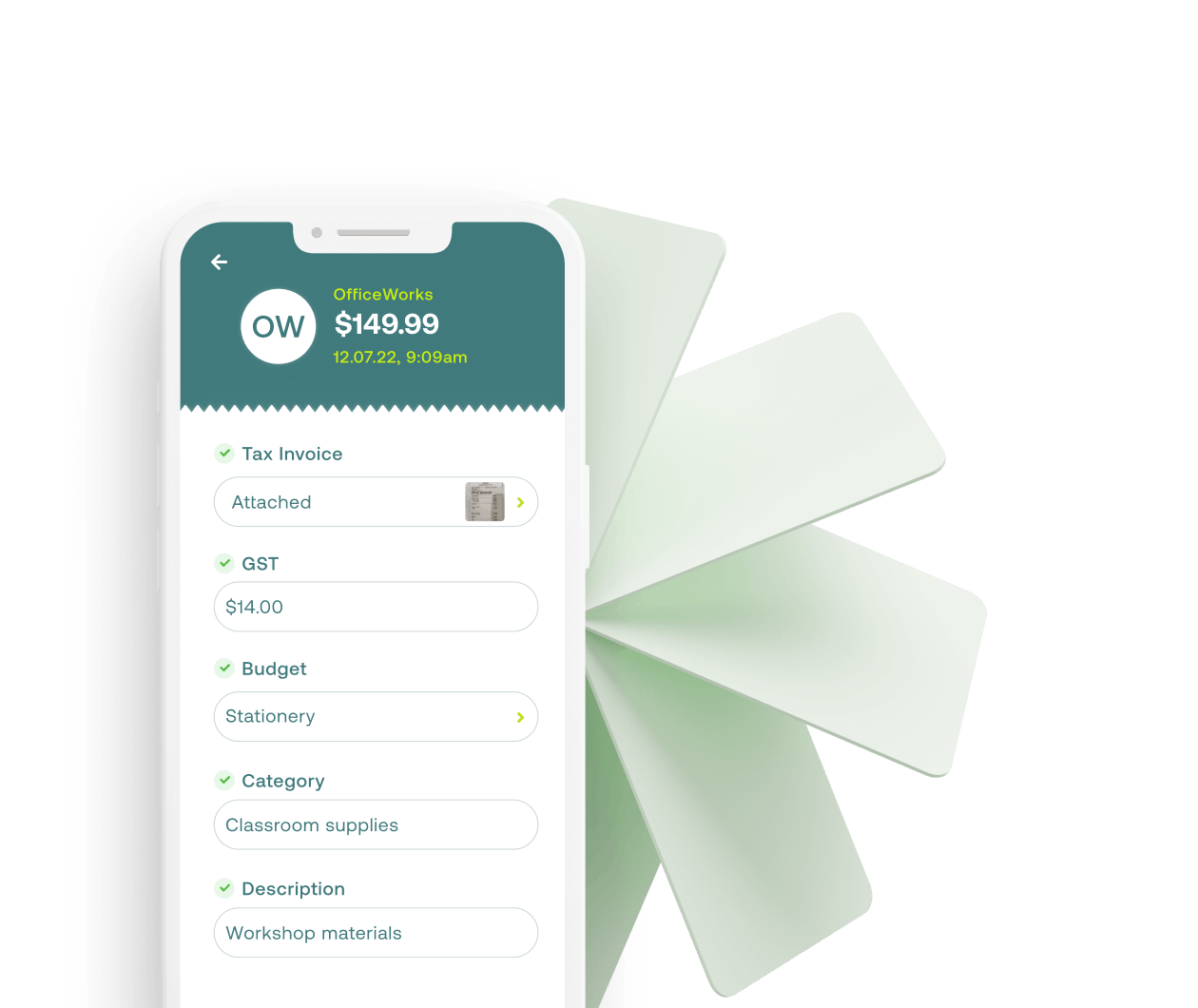

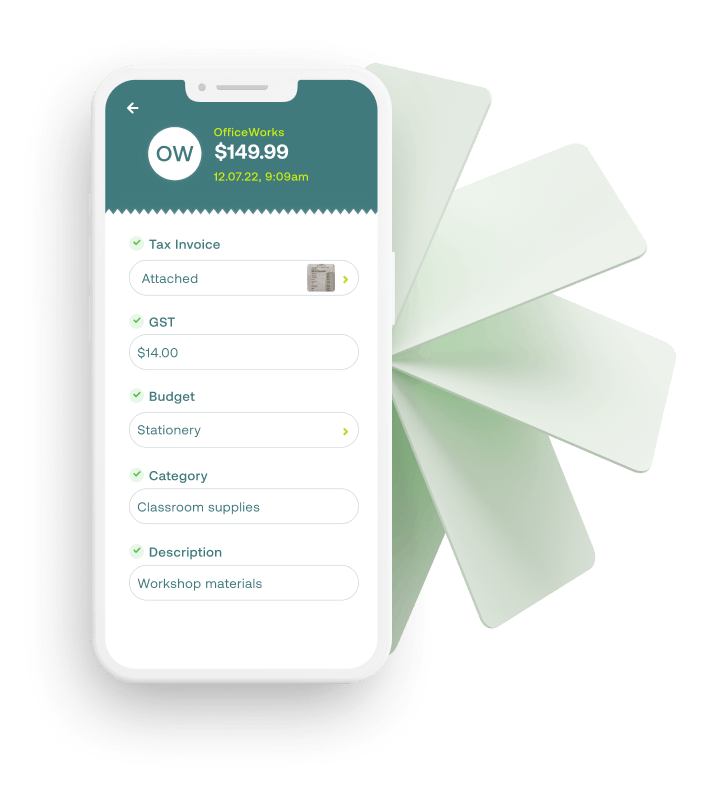

Compliance as you go

Capture receipts and expense categories at the time of payment and automate your expense reporting.An error-free zone

Say goodbye to scattered spreadsheets and human error. Seamlessly sync each purchase with Xero.Effortless reconciliation

Review, categorise and reconcile transactions in one place. Our direct feed sends transaction data to Xero every hour.Accurate, streamlined bookkeeping

Connect

Integrate Weel with Xero in a few clicks

Map

General Ledger codes and categories are mapped into Weel, ready for coding

Track

Know when every transaction has been sent to Xero with Weel’s status updates

Sync

Once a transaction is approved, it will be sent from Weel into Xero, receipts and all

Skip the back and forth.

Capture every payment within a single tool, and send your completed expense reports directly to Xero

Get Weel

Streamline spending across every way you pay with Weel

Corporate Cards

Pay with virtual cards that have built-in budget controls.

Bill Payments

Manage, approve and schedule bill payments with bank transfer

Subscription Management

Create, track and cancel recurring subscriptions from one place.

Reimburse effortlessly

Submit, approve or process reimbursement payments in a matter of seconds.

Keep spending under control

Create spending rules to restrict merchants and transaction amounts. Multi level approvals let you build your expense policy into Weel. Budgets and a real-time transaction feed ensure that you always know where and why business expenses are occurring.

Optimise your expense management process

Weel automatically captures merchant data, GST, and General Ledger codes from each transaction, saving your staff hours of expense reporting each week. Use our Custom Workflows tool to determine when an expense should be imported into Xero, stopping missing or incorrect information from ending up in Xero.

Frequently Asked Questions

Will receipts and tax invoices from Weel sync into Xero?

Yes, receipts and tax invoices will automatically import into Xero so you can reference the source document. With Weel's Custom Workflows, you can choose when receipts and invoices are sent to Xero.

Can I import my chart of accounts and tracking categories into Weel’s expense software?

Yes, your chart of accounts and tracking categories can import into Weel so that they can be coded against each transaction.

I use Xero Expenses for expense claims, how is Weel different?

Weel allows you to instantly issue all staff with access to their own virtual corporate card. Your team no longer need to use their own funds and then submit an expense claim via Xero Expenses. By using the Weel corporate Visa expenses are automatically categorised and will appear in Xero in real time ready to be reconciled.

Is it easy to integrate Weel’s expense software with Xero?

Yes, integrating Weel with Xero can be done in just a couple of clicks. You can read more about it here.

Will changes made to expense data in Weel automatically update in Xero?

Yes, any changes made in Weel will be automatically reflected in Xero ensuring that both systems are kept up-to-date. The only exception to this is when a transaction has been reconciled or an accounting period has been locked.

Can I choose when the data flows into Xero?

Yes. With Custom Workflows set up, you can set which data you want to flow into Xero and when.