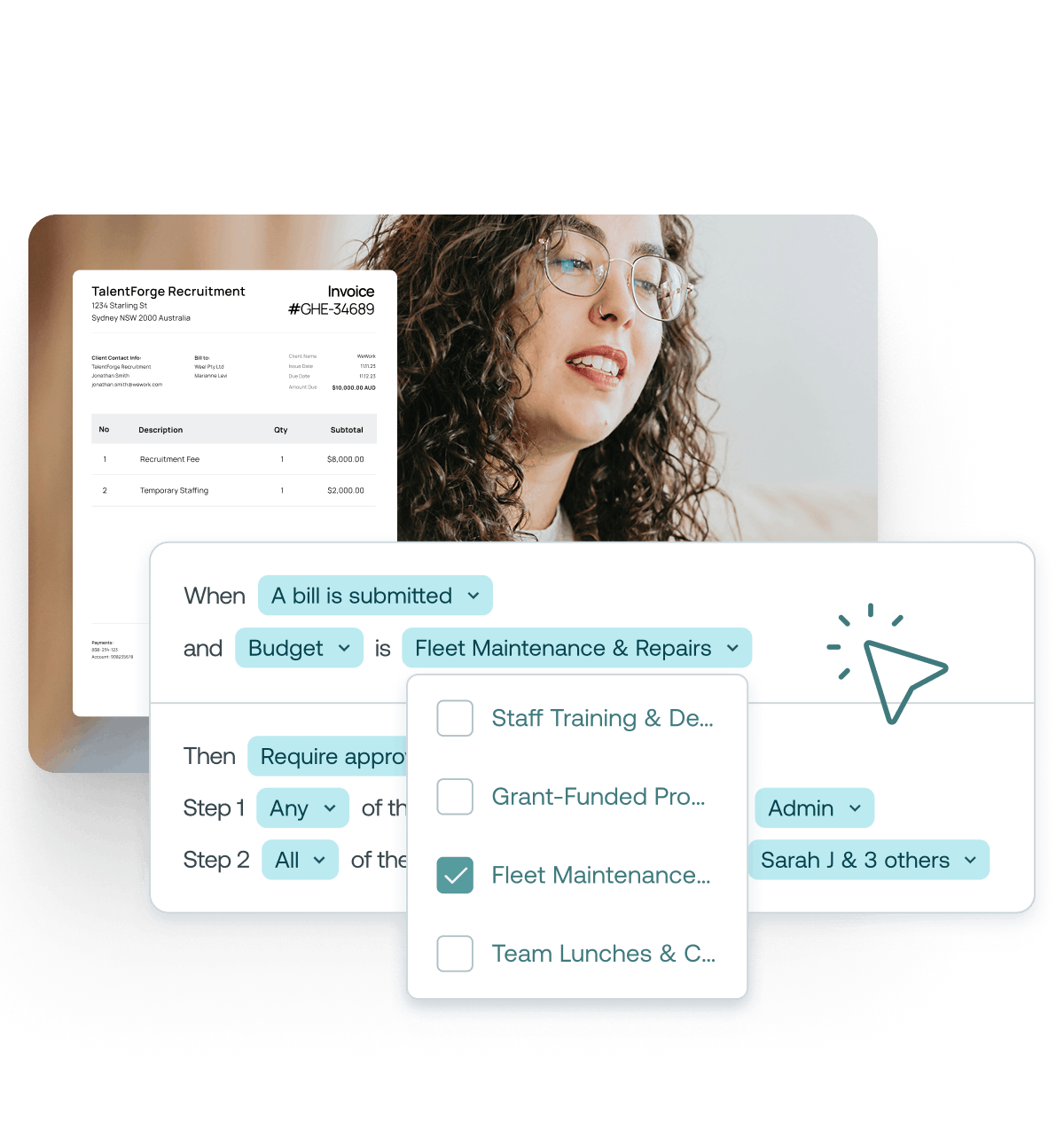

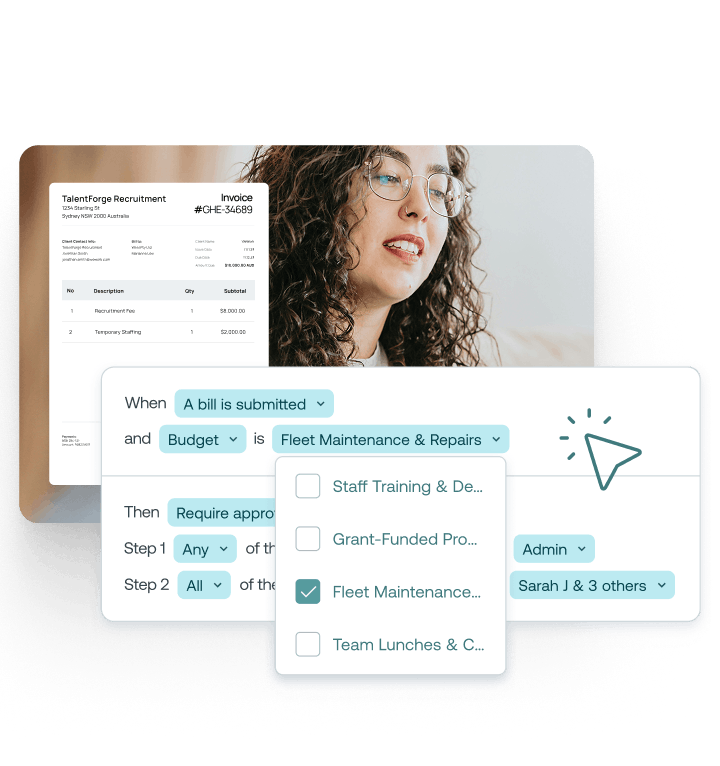

Approvals, for all the ways you pay

Build your approval matrix for card payments, bills, reimbursements and budget increases into Weel. Watch as each item is sent to the right approver at the right time, automatically.

Stop losing valuable hours to inaccurate expense reports, endless email threads, and stacks of printed invoices. Weel helps finance teams work through their approvals in record time.

Build your approval matrix for card payments, bills, reimbursements and budget increases into Weel. Watch as each item is sent to the right approver at the right time, automatically.

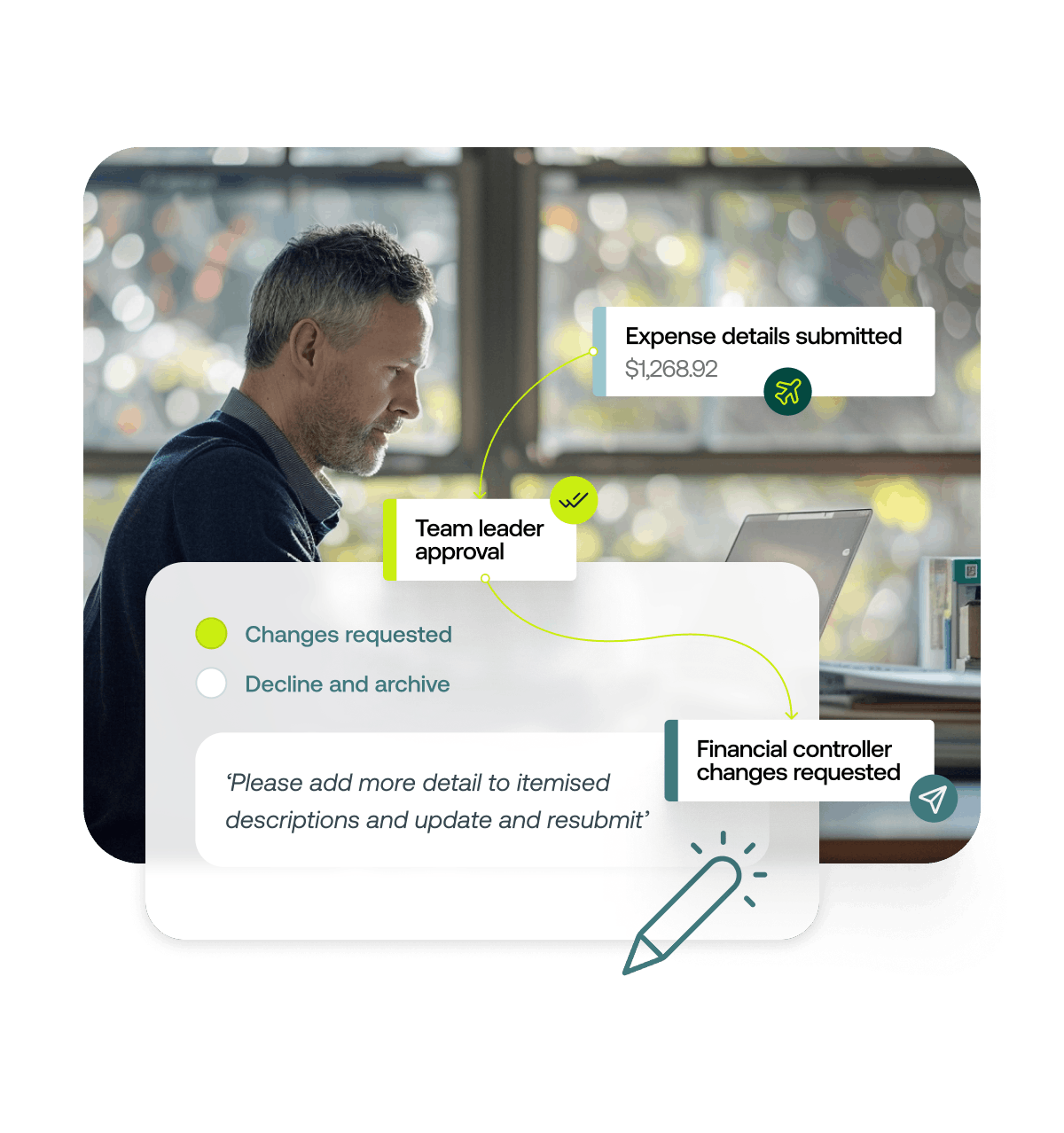

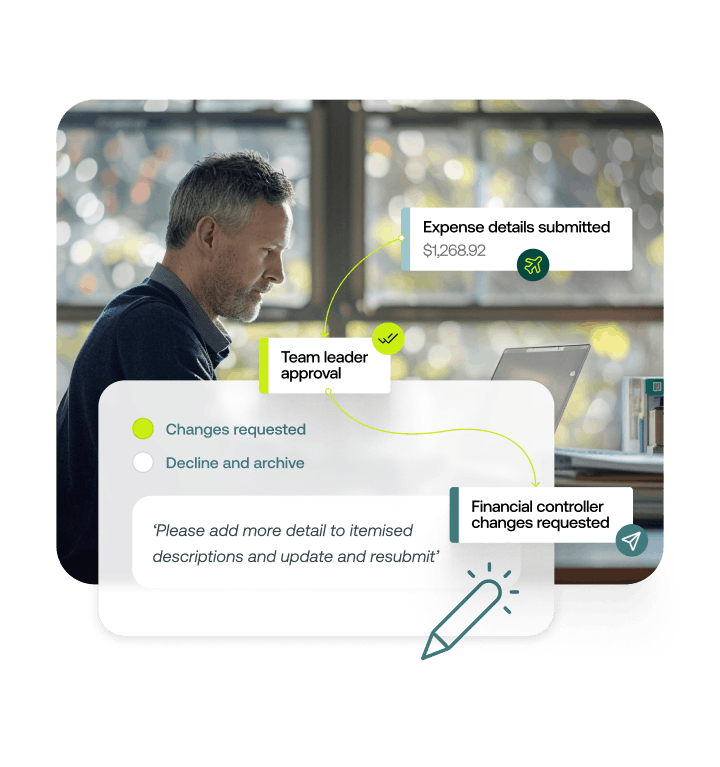

Save hours of re-work time every month with Weel’s decline comments and resubmission workflow. Designed to empower team leaders to handle expense reviews and train staff on complicated expense coding on the spot.

Custom approval notifications

Get notified right when you’re ready to approveCustom views

Filter down to what needs your attention or expand to see all pending approvalsFast approvals

Review in detail or approve at a glanceApprove from anywhere

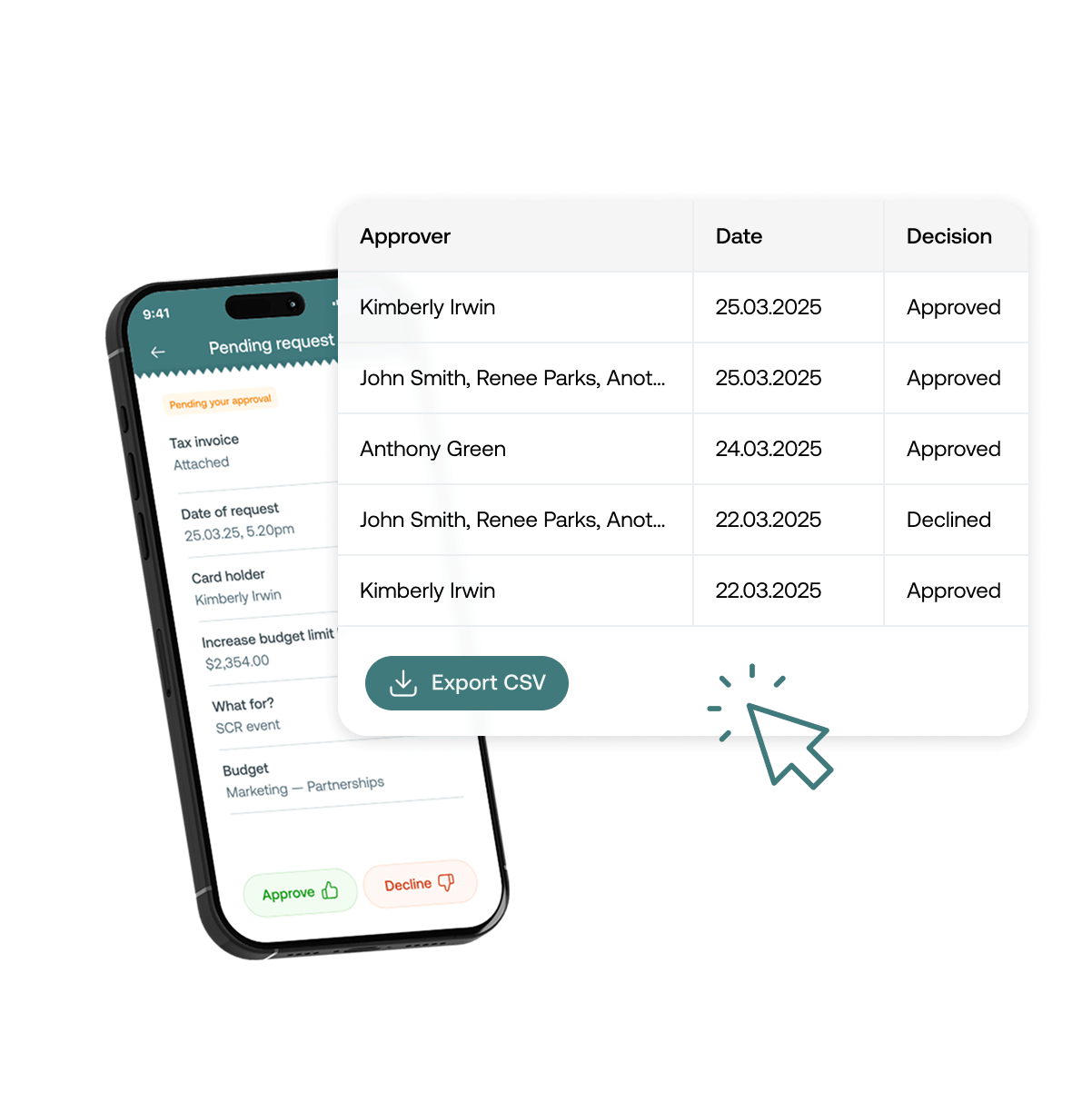

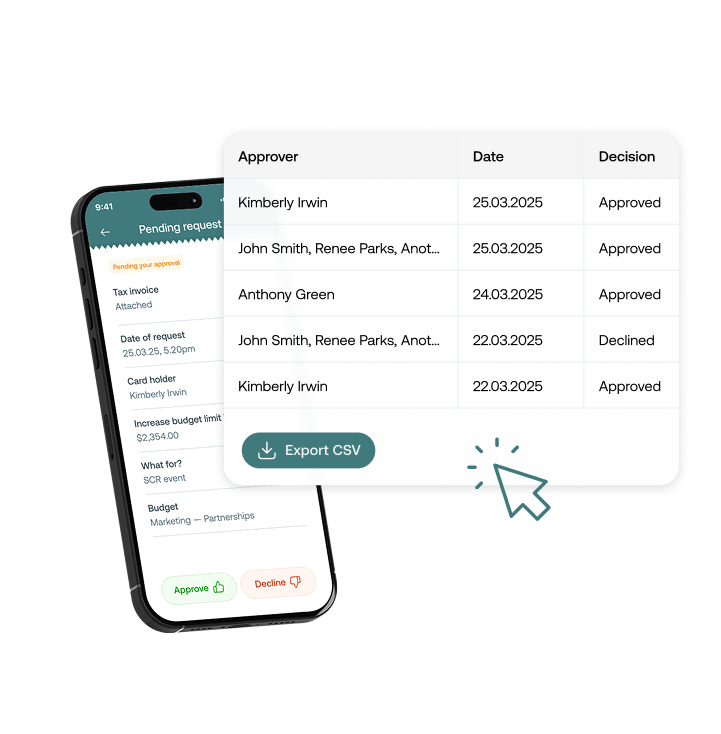

Approve from web or on the go from our mobile appApproval decisions are automatically recorded on an exportable audit trail ready to share with your auditors and board at any time.

Kaia Kaldoja, Head of Bookkeeping, BlueRock

With Approval Policies, finance managers can set the approval workflow that works for their business. Anyone who is nominated as part of the approval workflows will be allowed to approve transactions.

With Approval Policies, you can choose the expense export fields that must be completed for an expense to be created in your accounting system (ASP). With all the information you need being carried over to your ASP, you can spend less time reconciling expenses, and more time finding other finance efficiencies.

Approval Policies is designed to fit with your company’s existing expense policy. Whether you need to manage spend approvals by budget, by employee or by amount, Weel has got you covered.

Yes. With Approval Policies set up, you can set which data you want to flow into your existing ASP and when. You can find more information on the accounting software we work with here.

Approval Policies allows finance managers to put all the checks and balances in place to ensure that the company expense policy is being followed. Through automating adherence to the expense policy, financial risk is greatly reduced.

When an employee submits a reimbursement, finance managers can allocate who needs to be involved in the sign off process. This provides the extra backstop that any reimbursements expenses are within the expense policy.

Process multiple payments and approvals in minutes — all in one platform.