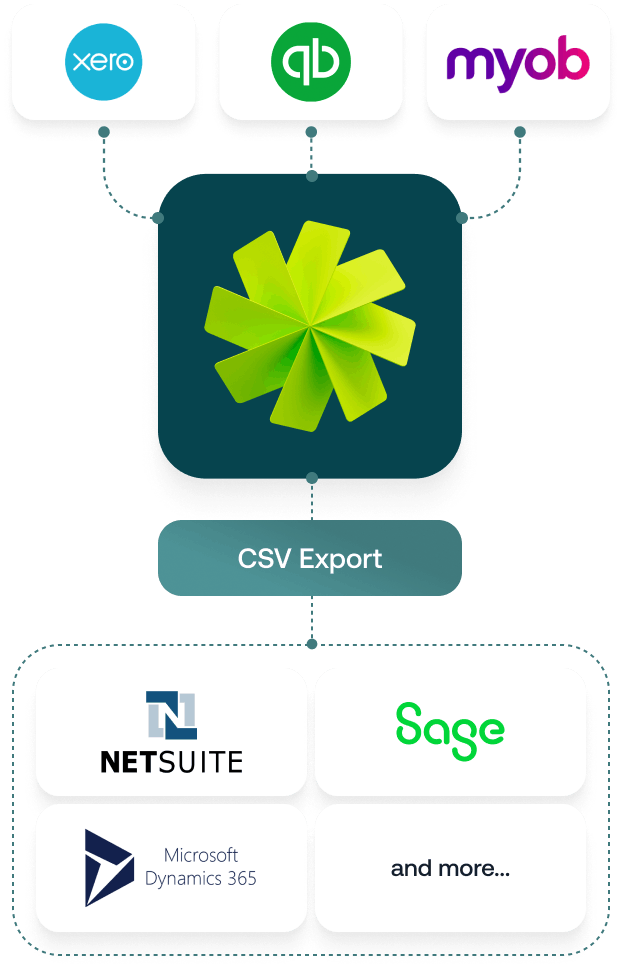

No-fuss integrations to implement with ease

Transactions with receipts attatched, push into your accounting software the moment spend is approved, ready for a speedy month-end close.

Start with a free 14 day trial, and never look back

With spending controls and custom limits built into every card

Using in-app receipt capture and on-the-go expense reports

So you can manage all your spending in one, central place

Connect your accounting software, and close the books in minutes

$119

/ month

$340

/ month

$2025

/ month

“Weel is a game changer for admin and finance. I have recommended Weel to any who has credit card spending by more than one person in the business or who has several subscriptions that need managing.”

Transactions with receipts attatched, push into your accounting software the moment spend is approved, ready for a speedy month-end close.

Free 14 day trial. No credit card required.

Weel's virtual corporate cards, or virtual expense cards, work the same way plastic cards do, the only difference is that the virtual cards live on your phone instead of your wallet. The Weel virtual Mastercard is a reloadable virtual prepaid card that can be used anywhere online or in-store that Mastercard is accepted. To use your Weel cards you need to first have funds available in your Weel account.

Yes, the Weel virtual card will replace your corporate credit card program. With Weel you can control your spending before it happens. Create budgets, control limits, make payments, review spending and automate reporting with Weel's simple expense software.

Yes, we offer a 14 day free-trial to help you assess if the tool is right for your business. If you are happy with Weel just keep using it and you will roll-over into your standard billing cycle once your free-trial is over. If Weel isn’t the right fit for you, just get in touch with our customer service team and we’ll help you close your account and transfer any remaining funds back to you.

Weel takes security very seriously. Our virtual corporate cards are supported by Mastercard's security processes and all card information is stored with our PCI-DSS level 1 compliant payment providers. To keep your personal information safe, we use 256-bit encryption and store it within highly secure AWS data centres located within Australia.

Yes, Weel works seamlessly with all accounting systems. If you are a Xero, MYOB Account Right or Quickbooks user Weel will automatically import all transactions into your accounting software for you. If you use any other accounting software you can use Weel’s smart filters and exports to generate a custom CSV ready for import into your system.