Product

Solutions

Resources

Welcome to the September edition of the Weelhouse Wire, your monthly download from the Weel HQ.

If your month-end close still feels like a race against the clock, you're not alone. This issue, we’re digging into the finance bottlenecks no one talks about (but every team feels), and how smart automation is quietly transforming the close process.

Here's what's inside this month:

Found this newsletter helpful? Forward it to a teammate and share the insights.

These stories sparked conversation at Weel HQ, so we’re passing them on to you.

Closing the books should be a process, not a panic. But for many teams, it’s still a sprint against the clock.

In our latest poll, 42% of finance teams reported their month-end takes 5–7 days, with 1 in 8 saying it takes 11+ days, and less than 10% completing it in 3 days or less.

They’re not alone.

This tells us something deeper: the challenge isn’t just closing faster, it’s closing cleaner.

The real blocker? Cluttered systems, fragmented workflows, and manual tasks.

It’s why more teams are adopting finance automation tools to:

Our take? Month-end shouldn’t be a mad dash. It should be the clean, confident finish to a system that’s working well.

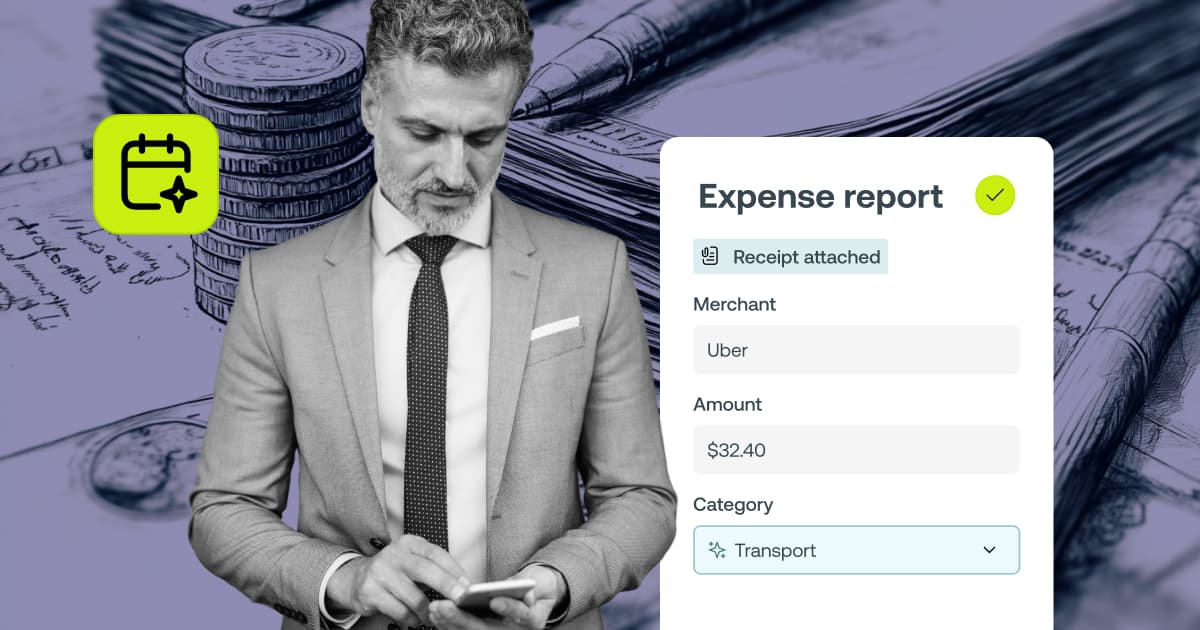

Whether it’s receipts, approvals, or expense reviews, the manual steps can add up fast. Our AI and automation tools take care of the repetitive stuff, so you and your team can focus on what matters most.

What’s inside:

Ready to automate the manual stuff?

Book a demo if you're new to Weel or talk to a Success Manager today.

We’re not into flashy features for the sake of it. These updates came from customer requests, so if they save you time, you can give some kudos to your peers!

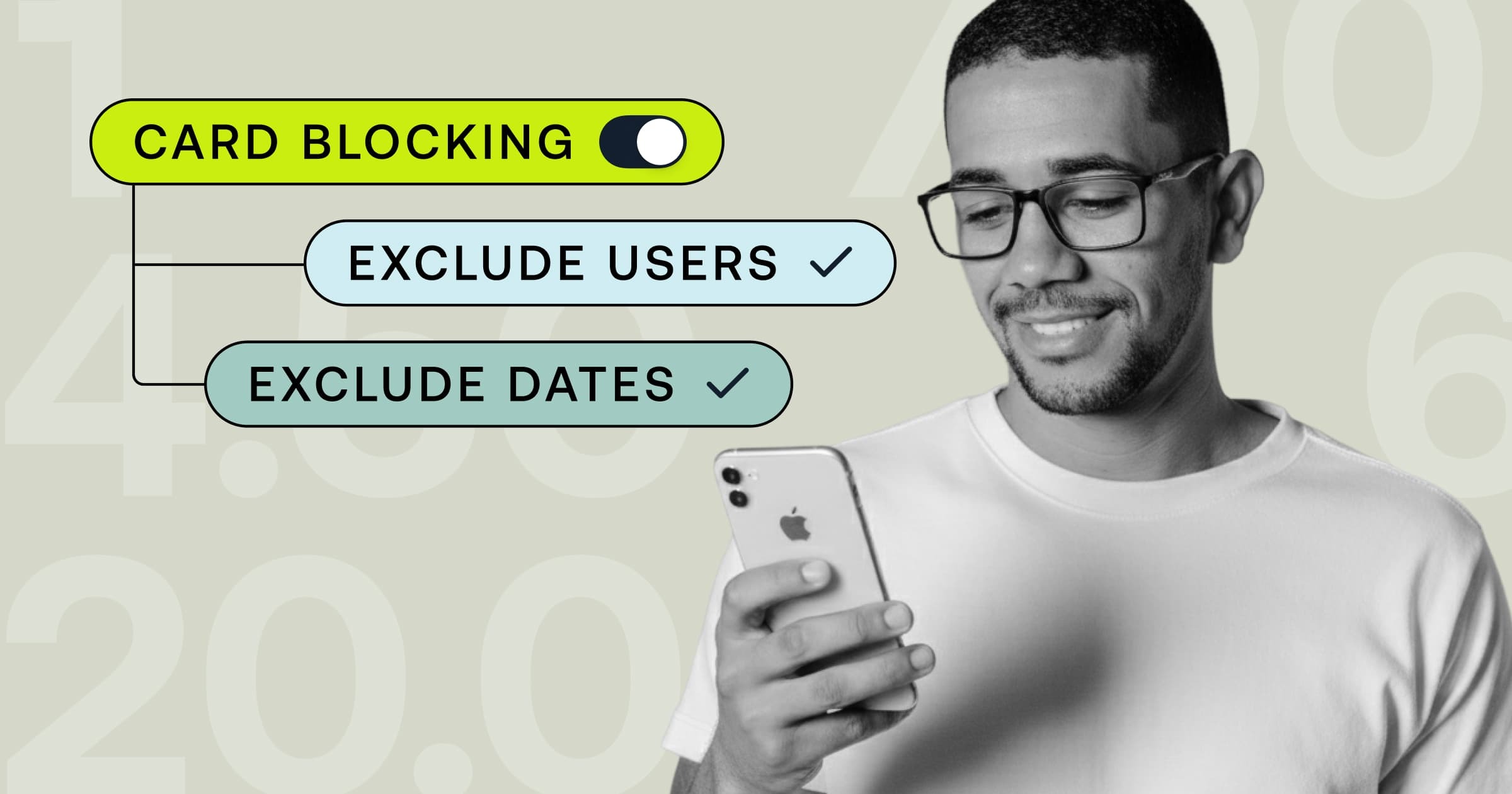

You can now exclude specific users from card blocking and set a start date so that only recent, relevant expenses are counted. That means more ways to tailor compliance to how your team works.

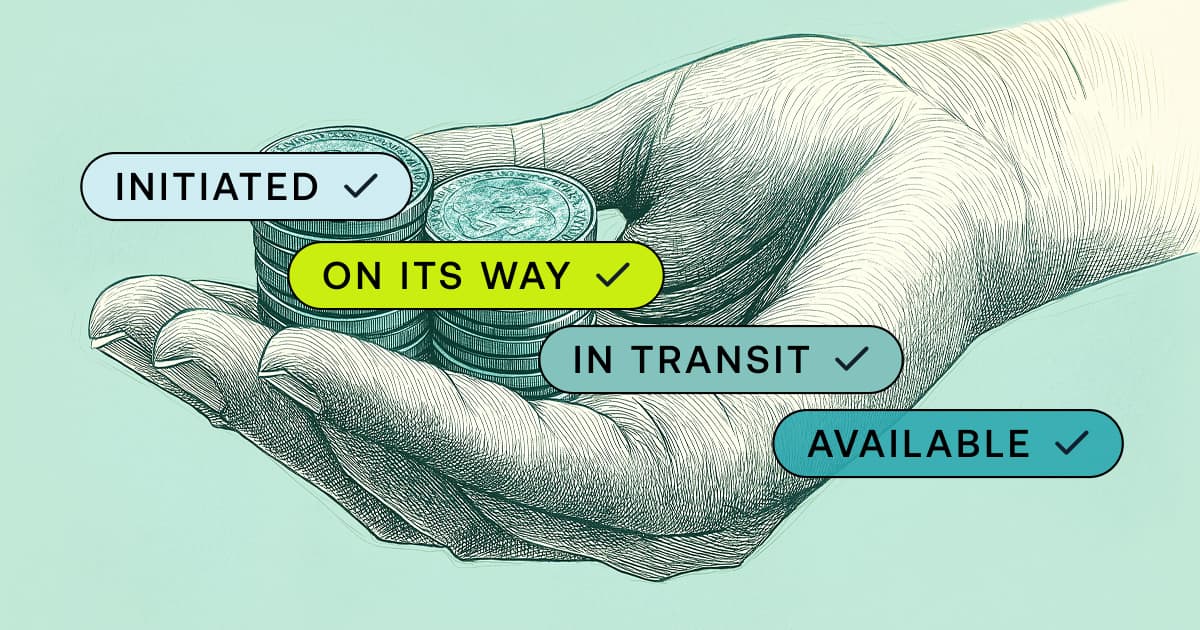

No more wondering where your funds are. When you top up your Weel account via direct debit, you’ll now see the full status of your payment from initiated to landed.

Running a report? You’ll now see the full attendee list in your CSV export, so you know exactly who each transaction involved.

Better visibility for accounting, audits, and compliance.

We’ve just wrapped our fifth Xerocon, and this year felt like a real turning point.

The conversations weren’t just about tools; they were about transformation. One thing came through clearly: finance teams are ready to stop juggling systems. They want one place to manage it all - from cards, to reimbursements, all the way to AP - and they’re looking to Weel to help make that happen.

Our Director of Partnerships, Lauren, summed it up perfectly:

“A customer told me they’ve shaved two days off month-end with Weel, and still feel completely in control. That’s the win.”

And that’s what made this Xerocon different.

From reconnecting with partners like The Breakthrough Office, Sports Accounting, and SRJ Walker Wayland, to swapping ideas with the Xero team and fellow apps, there was real energy around what’s possible and what’s next.

We walked away more energised than ever, with one thing top of mind: finance teams aren’t just asking for better software. They’re asking for a better way to work.

Couldn’t make it to Brisbane? Explore Xero's Xerocon wrap-up

Want to integrate your Xero account with Weel? Check out our Xero integration or book a demo to see what's new.

We're building Weelhouse Wire for finance teams who want an edge.

What should we keep? What should we drop? What do you want to see in next month's newsletter?

Reply directly to this email and let us know your feedback. We read every email.

Found this newsletter helpful? Forward it to a teammate and share the insights.